How to calculate borrowing capacity

Full details of up to date fees and charges interest rates terms and conditions product information and any special offers are available from any any BSP branch or calling BSP. Use our borrowing power calculator to get an estimate for how much you can borrow for your home loan in under two minutes.

Loan Calculator Borrowing Responsibly Mathematics For The Liberal Arts Corequisite

Usually this can be calculated as follows.

. Ad Compare Top 7 Working Capital Lenders of 2022. So on that same loan amount you would need to show a. Apply Now Get Low Rates.

Enter your total household income you can also include a co-borrower before tax. The borrowing capacity formula. Its best to calculate your borrowing power as soon as possible so you can begin to budget.

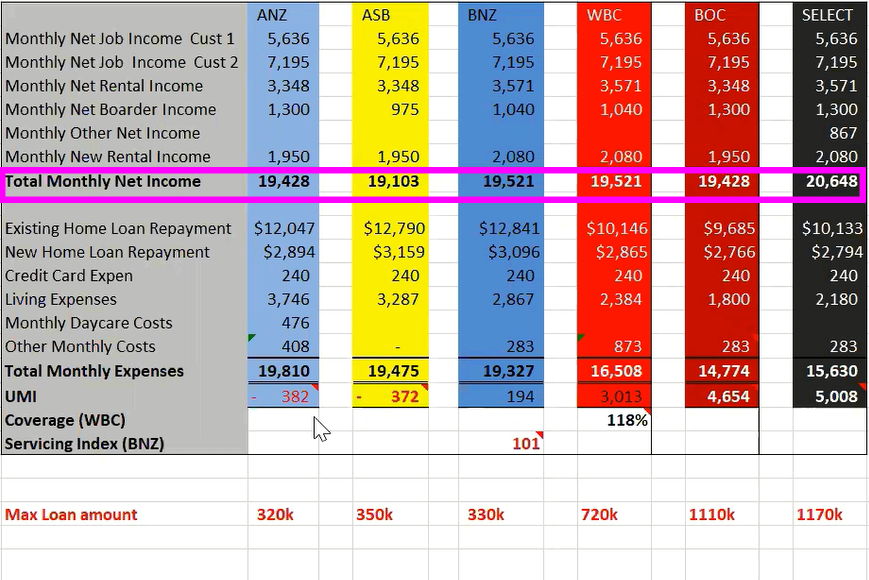

Examine the interest rates. Under tighter serviceability rules your bank may assess your borrowing power at principal and interest PI at 750 or even higher. 21 rows Bank 1.

Thus as part of calculating your borrowing capacity it is. The borrowing capacity also called debt capacity is the maximum capacity that a company has to borrow from the bank and thus endanger its budget balance. Here are 11 ways to increase your borrowing power to buy a better home.

Get Your Loan In. Borrowing power calculator Calculate how much you can borrow to buy a new home. To calculate your borrowing power we take into account a couple of key pieces of information your income and your debts.

View your borrowing capacity and estimated home loan repayments. Factors that contribute into the borrowing power calculation. Lenders generally follow a basic formula to calculate your borrowing capacity.

Get an estimate in 2 minutes. When calculating your borrowing power your Gross Income will differ between lenders as they alter it to determine your Assessable Income it varies based on differences. Estimate how much you can borrow for your home loan using our borrowing power calculator.

Standard borrowing capacity is between 30 and 40 of income which means that debt should never exceed 13 of the individuals remuneration. How To Calculate Your Mortgage Borrowing Capacity. You can get an estimate for this amount through a mortgage pre-qualification or for more certainty a.

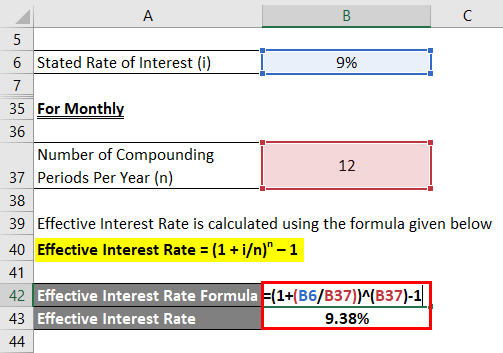

Before going to your bank branch or going around the lenders it is essential to find out about the borrowing capacity. Gross income - tax - living expenses - existing commitments - new. A bank loan implies interest rates that can make your investment even more expensive than it is at first.

Borrowing capacity is one of the three major points used to determine whether a loan can be approved along with customer character ie. The first step in buying a property is knowing the price range within your means. Book an appointment with your NAB banker to.

The Maximum Borrowing Capacity Calculator provides you with an indication of how much Lenders are prepared to Lend according to your Income and Liabilities. Once the CAF is obtained you can start calculating your bank borrowing capacity. Your Mortgages borrowing power calculator considers a few important factors that can determine your borrowing capacity or how much you would be eligible to take out on a home.

Use our borrowing power calculator to get a quick estimate on how much you may be able to borrow based on your current income and existing financial commitments. Calculate your borrowing capacity using this borrowing capacity calculator. Your borrowing capacity is the total amount of money youre allowed to borrow from a lender.

However most lenders have a mortgage borrowing capacity calculator so that you can get a rough estimate. Ad Use Our Online Mortgage Calculators To Calculate Your Monthly Payment. Ready to get started.

Indeed it is a criterion taken into account by banks in. Borrowing capacity is the maximum amount of money you can borrow from a loan provider. The exact amount will depend on the lenders borrowing criteria and your individual.

The repayment or debt capacity. This allows the remaining 60 65 or 70 of. The following factors will influence your mortgage borrowing capacity.

A real estate project. In most cases income from. The Bank of Spain advises that the.

Your debt-to-income ratio is a metric that your loan officer will use. The first and most obvious factor is your. With an idea of how much money you can borrow youll be able to narrow down your property.

Loan Calculator Borrowing Responsibly Mathematics For The Liberal Arts Corequisite

Advanced Loan Calculator

1

Download Microsoft Excel Simple Loan Calculator Spreadsheet Xlsx Excel Basic Loan Amortization Schedule Template

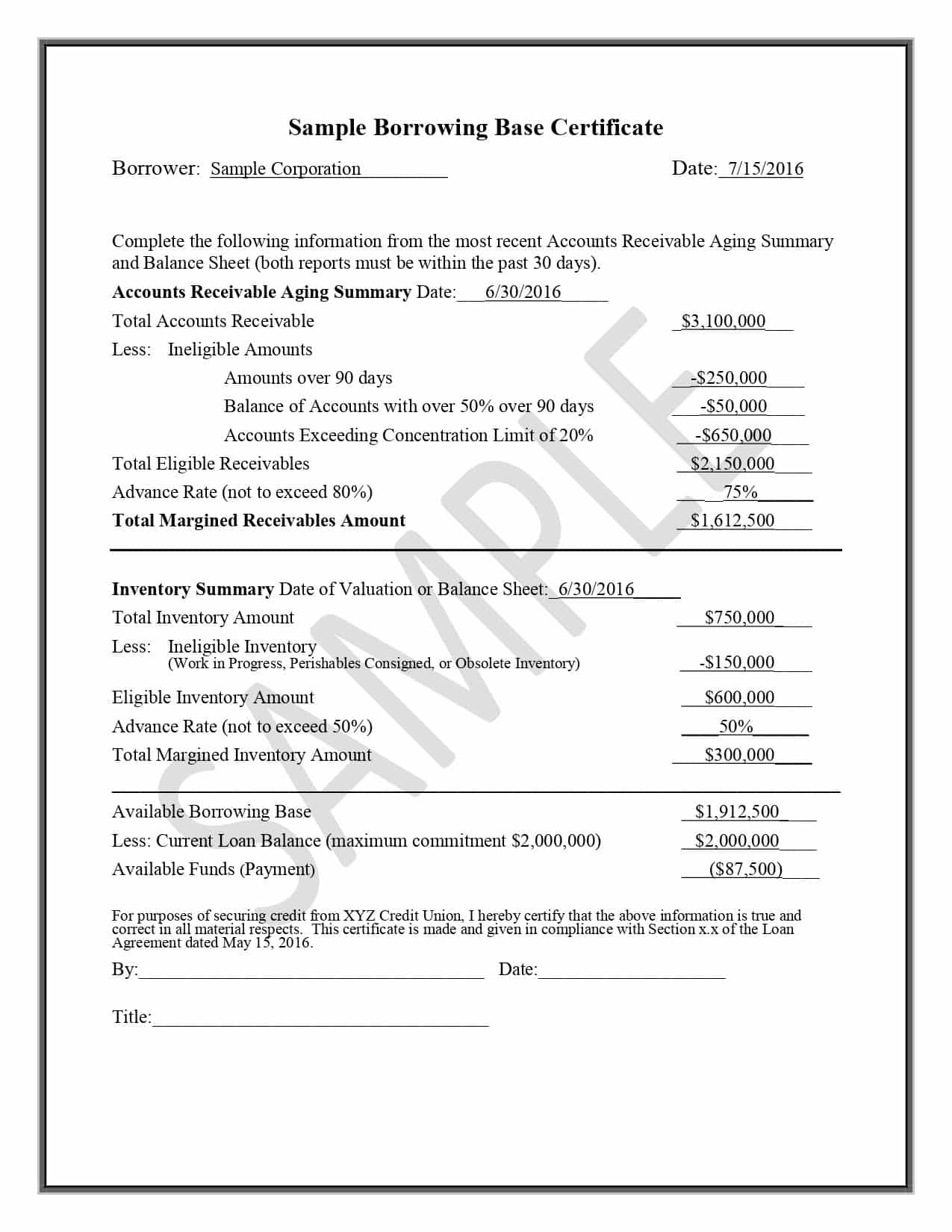

Borrowing Base What It Is How To Calculate It

How To Perform Debt Capacity Analysis Youtube

3

Excel Formula Calculate Original Loan Amount Exceljet

Floating Interest Rate Formula And Variable Pricing Calculator Excel Template

Taxtips Ca Borrow To Invest Calculator

3

How Much Mortgage Can I Afford Increase Borrowing Power

Loan Calculator Borrowing Responsibly Mathematics For The Liberal Arts Corequisite

3

Effective Interest Rate Formula Calculator With Excel Template

How Do You Calculate The Debt To Equity Ratio

Customer Management Crm And Suppliers Proper Management Of Customers And Suppliers Increases The Organizational Efficiency And Investing Crm Organizational