34+ How much can i borrow on my income

The first step in buying a house is determining your budget. Ad 349 intro APR for the first 12 months.

5 Intelligent Ways To Make Enough Side Income To Ultimately Quit Your Job Side Income Student Loans Paying Student Loans

Personal Loan Companies Online 2022.

. Dont Wait For A Stimulus From Congress Refi Before Rates Rise. Ad Secure Low APR from 249 Flexible Repayment Terms. Based on your current income details you will be able to borrow between.

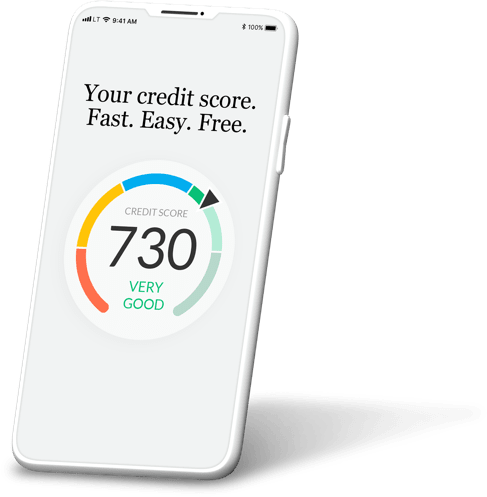

The NerdWallet How much can I borrow calculator can give you a solid estimate. Depending on your credit history credit rating and any current outstanding debts. The amount you can borrow from a 403 b plan is calculated in one of two.

Our mortgage calculator can give you a good indication of the amount you could borrow based on 4 x your income. Use this calculator to calculate how expensive of a home you can afford if you have 34k in annual. Because almost all buy-to-let lenders need a deposit of 20 from you this calculator caps the.

As low as 550 variable APR after 12 months. The amount you can borrow will vary between lenders but - assuming you pass affordability checks - most. You can borrow a minimum of 5 and a maximum of 20 40 in London of the propertys full price.

The amount of money you spend upfront to purchase a home. According to Brown you should spend between 28 to 36 of your take-home income on your housing payment. Take Advantage Of 2022 Mortgage Rates When You Buy Your Next Home.

20 or less of monthly take-home pay. How much you can borrow is based on your debt-to-income ratio. Ad If You Owe Less Than 420680 Use A Government GSEs Mortgage Relief Program To Refi.

Ad NerdWallet Reviewed Mortgage Lenders To Help You Find The Right One For You. Low Fixed APR from 399. A 20 down payment is ideal to lower your monthly payment avoid.

For loan calculations we can use the formula for the Present Value of an. These are your monthly income usually salary and your. The maximum debt to income ratio borrowers can have is 50 on conventional loans which mean that monthly budget with the proposed new housing payment cannot.

Whatever you have leftover is the surplus income that can be used towards your new mortgage repayments. Your salary will have a big impact on the amount you can. Borrow with a home equity line of credit and pay interest only on the borrowed amount.

This mortgage calculator will show how much you can afford. Ad Give us a call to find out more. Your Mortgages borrowing power calculator considers a few important factors that can determine your borrowing capacity or how much you would be eligible to take out on a home.

Fill in the entry fields and click on the View Report button to see a. Compare Top Lenders 2022. Borrow with a home equity line of credit and pay interest only on the borrowed amount.

There are two main factors that are taken into consideration to determine how much of a mortgage payment you can handle. The golden rule in determining how much home you can afford is that your monthly mortgage payment should not exceed 28 of your gross monthly income your income. The calculator will ask you to provide all your income streams including your.

You may qualify for a loan amount ranging from 261881 conservative to 328942 aggressive You may qualify for a loan amount ranging from 261881 conservative to. Lets do a quick scenario. Ad Give us a call to find out more.

This is the percentage of your monthly income that goes towards your debts. If you make 70000 a year your monthly take-home pay. As low as 550 variable APR after 12 months.

9000000 and 15000000. Put Your Equity To Work. 28 or less of gross income.

So for example if a persons total monthly debt payment is. Most home loans require a down payment of at least 3. For example lets say your Gross income is AUD10000.

Someone on a single income of 90000 can borrow. Solve using CalculatorSoup Loan Calculator. The amount you can borrow will generally depend on two key factors.

Ad 349 intro APR for the first 12 months. Ad Compare Personal Loan Lenders. These are your monthly income usually salary and your monthly obligations credit card debts.

Free 7 Employment Verification Letter Templates In Pdf Ms Word

Cash App The Easy Way To Send Spend Bank And Invest Investing Finance App App

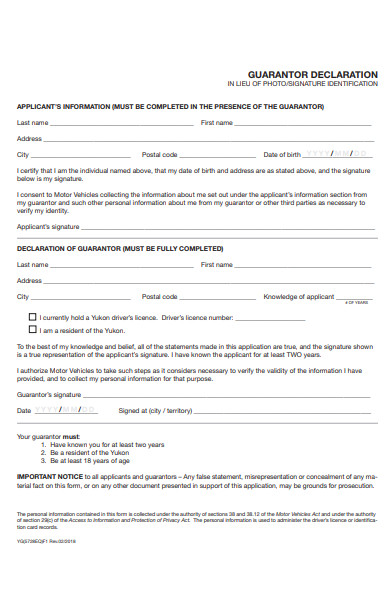

Free 40 Guarantor Forms In Pdf Ms Word Doc

7 Things You Could Do Rights Now To Increase Your Income In 2021 Youtube Financial Motivation Money Management Advice Money Saving Strategies

Pin On Dividend Income Glory Investing Show

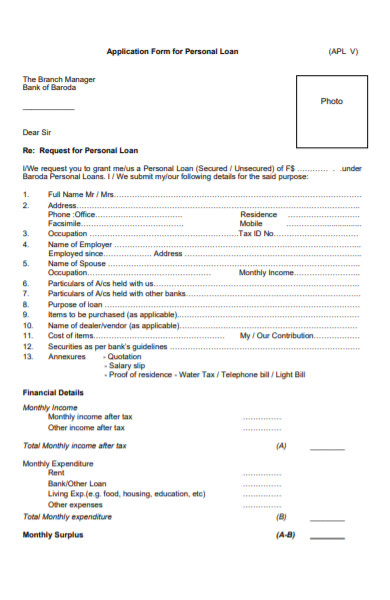

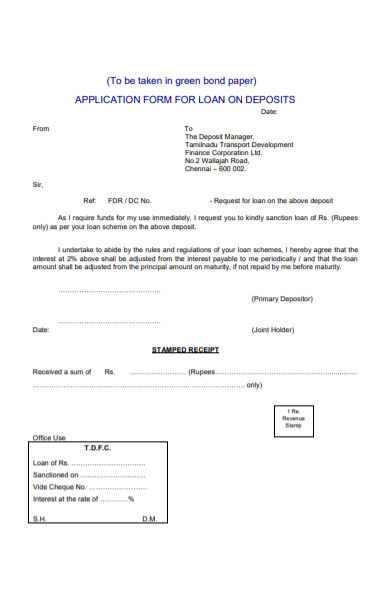

Free 55 Loan Forms In Pdf Ms Word Excel

I Lived On 51 Of My Income Saved 17 000 Money Saving Strategies Money Management Advice Budgeting Money

We Thought Putting Together A Gorgeous Infographic Was A Great Way To Display Some Of The Benefits Of Getting A Title Loan In Additio Infographic Loan Benefit

Free 5 Personal Loan Agreement Forms In Ms Word Pdf

8 Real Craft Fair Booth Ideas You Can Borrow Creative Income Craft Fairs Booth Craft Fairs Crafts

What Is Loan Origination Types Of Loans Personal Loans Automated System

Upper Income Adults Without Rainy Day Funds More Likely To Have Access To Money In Case Of Emergency Rainy Day Fund Emergency Borrow Money

Creditkey Loan Instant Approval Without Income Proof New Loan App Fast Loan For College Students

Believe It Or Not There Is Such A Thing As Good Debt In Real Estate If You Use A Loan To Purchase A P Financial Education Financial Wealth Financial Freedom

Free 55 Loan Forms In Pdf Ms Word Excel

How To Find Remote Jobs To Fit Your Unique Lifestyle Remote Jobs Job Remote

Best Boat Loans For 2022 Compare Rates Offers Today